3 Mistakes Retailers Make When Offering Buy Now, Pay Later

Buy Now, Pay Later (BNPL) has evolved from a niche payment option to a mainstream expectation among U.S. consumers. In 2025, approximately 91.5 million Americans are projected to use BNPL services, this number has been growing rapidly since BNPL became a payment option in 2019.

Whether you're selling high-end bikes, boutique pet gear, luxury jewelry, or golf equipment that costs more than a weekend getaway, BNPL has become a key lever to closing sales.

But here’s the kicker: just offering BNPL isn’t enough. In fact, rolling it out without a smart strategy can lead to clunky customer experiences, confused staff, and even lost revenue opportunities.

In this blog post, we dive deep into 3 common mistakes retailers make when implementing BNPL and share how to maximize its potential—especially when it's offered directly through text messaging with Ikeono.

#1 Offering BNPL on Every Product—Even When It Doesn’t Make Sense

Buy Now, Pay Later (BNPL) is a powerful tool—but only when used strategically.

One of the biggest mistakes retailers make is slapping BNPL on everything in their catalog, from high-ticket items to $10 accessories.

While it might seem like more payment flexibility equals more conversions, in practice, offering BNPL on every single product can create more friction than it resolves.

Here’s why: when customers see BNPL on items that don’t warrant installment payments, like a dog collar or a basic water bottle, it can dilute the perceived value of the service. Instead of thinking “Wow, I can afford that $1,200 bike with manageable payments,” shoppers start thinking “Wait, do I really need to finance a $30 leash?” That kind of dissonance can erode trust.

The Fix: Be Intentional

Use BNPL where it creates real buying momentum, think premium golf equipment, high-end jewelry, or boutique pet accessories.

Pair BNPL with items that usually cause purchase hesitation due to price. This way, you keep your checkout clean, your offer strategic, and your customers confident.

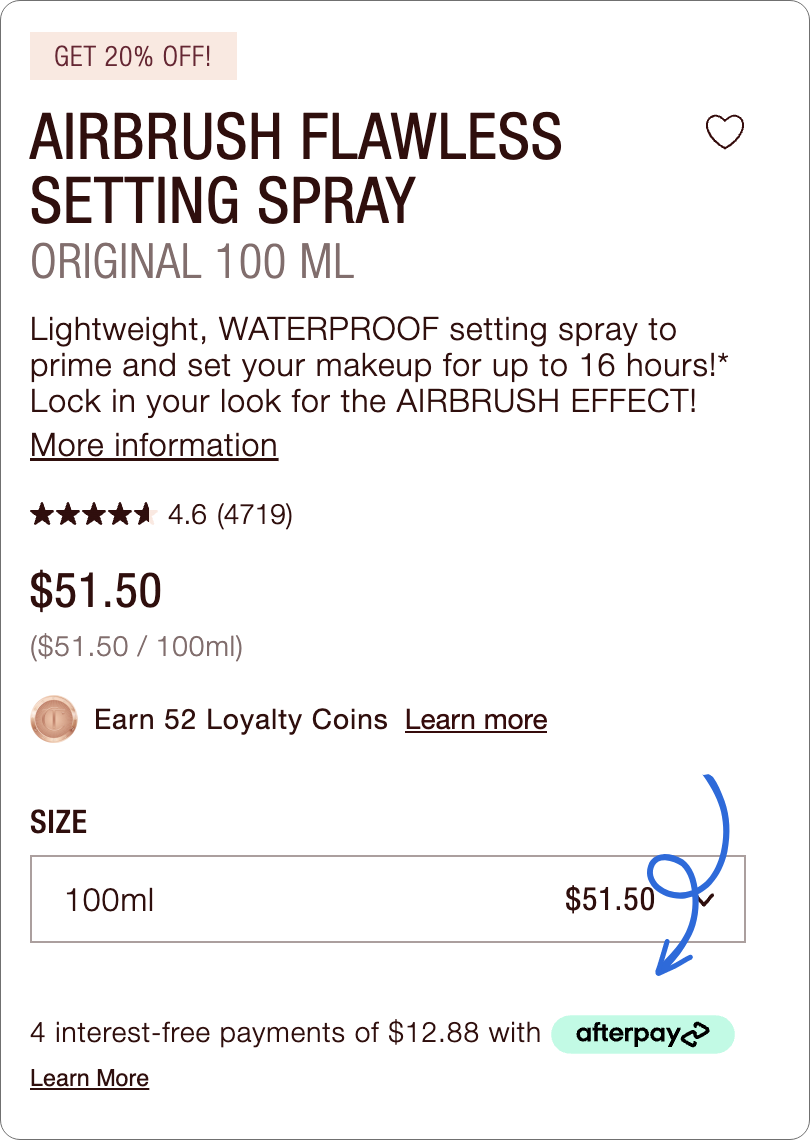

This retailer offers BNPL only on items above $100

#2 Treating BNPL Like a Passive Feature

BNPL isn’t a “set it and forget it” feature—it’s a sales tool.

But it’s often treated as such and ends up being a feature buried at checkout with no mention throughout the shopping experience, it’s not doing the heavy lifting it could.

Think of it this way: if you had a 0% financing promotion in-store, would you only mention it at the register?

Of course not.

You’d plaster it on signage, weave it into staff conversations, and feature it everywhere on your website.

Here’s why it matters: The volume of BNPL purchases totaled $116.3 billion in 2023 and is expected to reach $205.8 billion by 2029.

When used proactively, it can reduce cart abandonment, increase how much each customer spends, and make those “out of budget” items suddenly feel very doable.

The Fix: Be Anti-passive

Promote BNPL like a product, not a feature.

Add banners on product pages for eligible items, and bring it up in sales conversations via chat.

A jeweller making it clear right on their landing page that they offer offer financing.

Here are three common questions that come through web chat that you can easily pivot into a BNPL conversation:

"Do you ever run sales or discounts on this item?"

Response opportunity:

"Is this available in-store too?"

Response opportunity:

Retailers we think are getting it right:

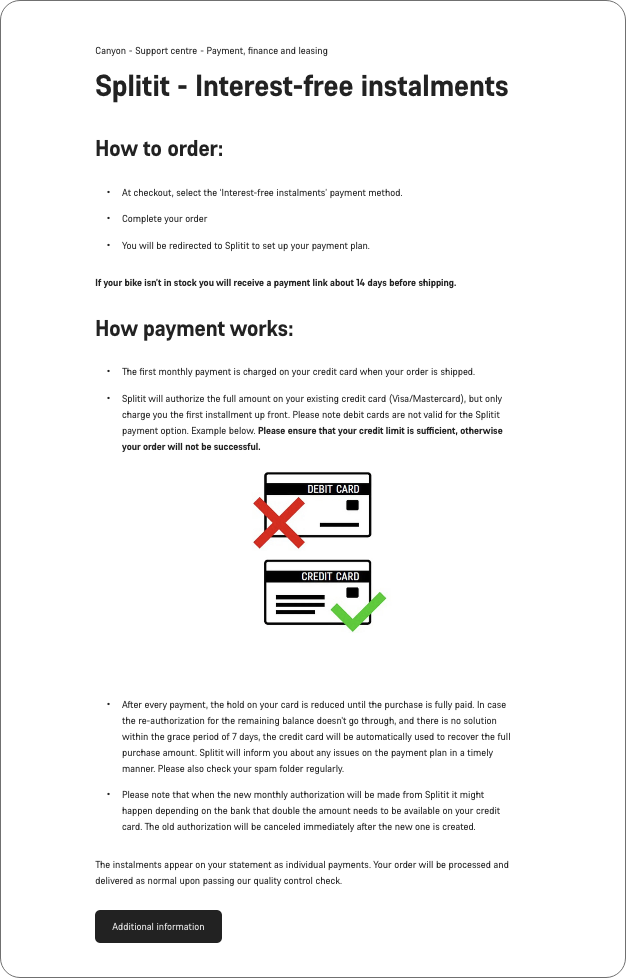

A dedicated section explaining payments and financing options

Actively pointing out BNPL on a product and showcasing the monthly breakdown.

Showcasing BNPL when shoppers are comparing products.

#3 Not Training Staff to Explain BNPL

Having BNPL available is one thing.

Creating a page like this not only helps your customers but can be used as training material for your team.

Having your team confidently explain it? That’s what actually drives conversions.

One of the most overlooked mistakes retailers make is assuming the tech will do all the selling. But if your staff doesn’t fully understand how BNPL works—or when to bring it up—it can quickly become a missed opportunity.

Whether it’s a sales associate in-store or a team member handling webchat, your staff needs to know when BNPL is appropriate to mention, how it benefits different types of customers, and how to clearly communicate the terms.

When shoppers hear “split it into four payments,” their next question is usually “Is there interest?” or “Does it affect my credit?”

Can your team answer these questions? If they can't confidently answer these questions then the trust in the process can vanish fast.

The Fix: Educate Your Team

Train your team like they’re part of the BNPL pitch.

Build a quick FAQ cheat sheet, run through a few common customer scenarios, and even script out some sample responses for webchat and SMS.

Better yet, create message templates so reps can respond with confidence and consistency, no matter who’s chatting.

Template Ideas

BNPL Introduction

Price Objections

Klarna Template

Affirm Template

Why Strategy Matters with BNPL

Buy Now, Pay Later (BNPL) isn’t just a passing trend, it’s a transformative shift in consumer purchasing behavior.

In 2025, nearly half of American consumers will have used BNPL services, with the average user being millennials and Gen-Zers.

However, with great power comes great responsibility.

The widespread adoption of BNPL also brings challenges. Reports indicate that 41% of users have made at least one late payment in 2025, up from 34% in 2024. This trend highlights the potential pitfalls of offering BNPL without proper customer education and support.

To harness the full potential of BNPL:

✨ Be Intentional: Offer BNPL on products where it adds genuine value, such as high-ticket items, rather than across the entire inventory.

✨ Be Anti-Passive: Integrate BNPL messaging throughout the customer journey—not just at checkout—to inform and entice shoppers.

✨ Educate Your Team: Ensure staff are well-versed in BNPL terms and can confidently address customer inquiries, fostering trust and clarity.

By implementing BNPL thoughtfully, retailers can enhance customer satisfaction, increase average order values, and stay competitive in a rapidly evolving market.